In addition to your credit score, your debt-to-income (DTI) ratio is an important part of your overall financial health. Calculating your DTI may help you determine how comfortable you are with your current debt, and also decide whether applying for credit is the right choice for you.

When you apply for credit, lenders evaluate your DTI to help determine the risk associated with you taking on another payment. Use the information below to calculate your own debt-to-income ratio and understand what it means to lenders.

Explore It Your Way:

How to calculate your debt-to-income ratio

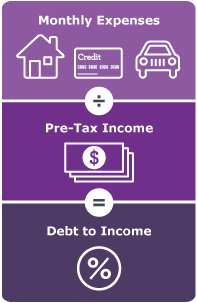

Your debt-to-income ratio (DTI) compares how much you owe each month to how much you earn. Specifically, it’s the percentage of your gross monthly income (before taxes) that goes towards payments for rent, mortgage, credit cards, or other debt. To calculate your debt-to-income ratio:

Step 1:

Add up your monthly bills which may include:

- Monthly rent or house payment

- Monthly alimony or child support payments

- Student, auto, and other monthly loan payments

- Credit card monthly payments (use the minimum payment)

- Other debts

Note: Expenses like groceries, utilities, gas, and your taxes generally are not included. See the FAQs for more information.

Step 2:

Divide the total by your gross monthly income, which is your income before taxes.

Step 3:

The result is your DTI, which will be in the form of a percentage. The lower the DTI, the less risky you are to lenders. For more information, see Understand what your ratio means.

Sign On

Sign On