by Courtney Buerger Schmidt, Sector Manager, Wells Fargo Agri-Food Institute and Lon Swanson, Sector Manager, Wells Fargo Agri-Food Institute

China has become a hot-button topic in many industries including agriculture. When discussing imports, exports, inventories, and prices, China is considered the “elephant in the room.”

China has become a hot-button topic in many industries including agriculture. When discussing imports, exports, inventories, and prices, China is considered the “elephant in the room.”

While Chinese data isn’t always available or reliable, the country’s size, population, and trading volumes can move markets. This has been the case for many years with numerous commodities. This reality remains in place for now, but what does the future hold for China and its agriculture relationship with the U.S.? How will the U.S. respond to the long-term outlook for China, and what impact will that have on the world market?

Why is China so influential?

China is the world’s largest agricultural import market. And, with the world’s largest population, food security is a top priority for China’s government. While China ranks as the top agricultural producer globally, it still must rely on imports to ensure sufficient supply to feed its enormous population.

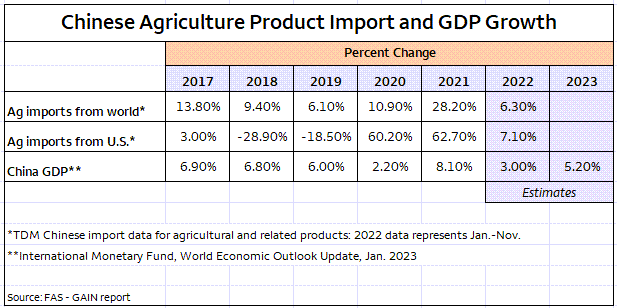

Using Chinese Customs data, in 2022, China’s top three suppliers of agricultural products were Brazil ($52.9 billion), the United States ($43.8 billion), and New Zealand ($14.6 billion). Since the U.S. has a surplus of many commodities, it’s likely to continue as a primary trade partner for China.

China is currently the largest food and agricultural product export market for the U.S. with sales reaching a record $41 billion in 2022. Despite China’s investments in expanding its domestic production of agricultural commodities, strong import growth is expected to continue in 2023 due to resource constraints and economic growth in rural area and mid-size cities.

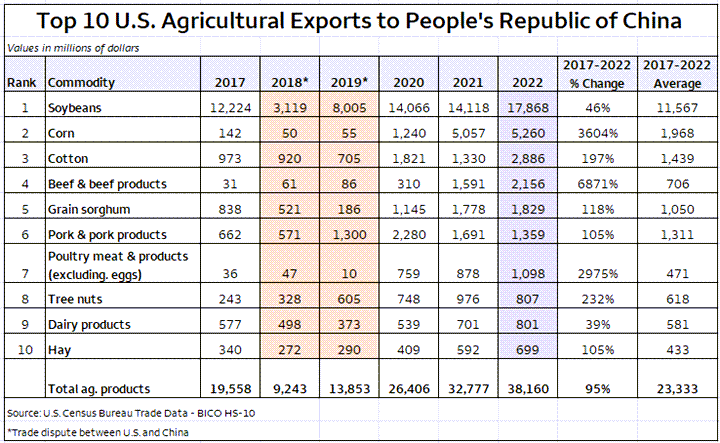

Soybean exports to China have long been a sizable and stable market for the U.S. Other commodities such as corn and beef have enjoyed strong export growth to China the last couple of years. Will strong export growth continue for these commodities? History shows mixed results. China often jumps in and out of the marketplace depending on various factors like weather events, disease, prices, and government policies. Due to China’s size and needs, their entry or exit into the global marketplace makes an impact.

How has China responded to challenges or opportunities?

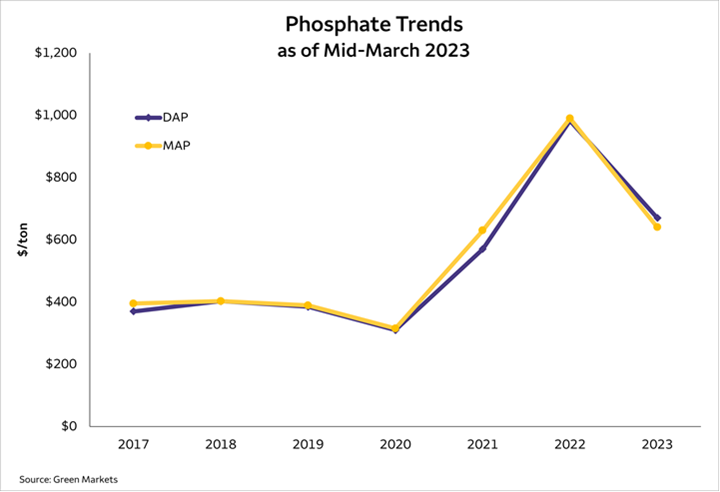

China accounts for 30% of global phosphate trade. In July of 2021, China enacted export restrictions on phosphate fertilizer to ensure an ample domestic supply of this nutrient to support the country’s food production. For a country of 1.4 billion people, the guaranteeing fertilizer supply is an issue of national security.

This quota limited total exports to 3.16 M Tons for the second half of 2022, down from 5.5 M tons for the same period of 2021. These restrictions contributed to the astounding 300% price increased for phosphate between 2020 and the market peak in 2022.

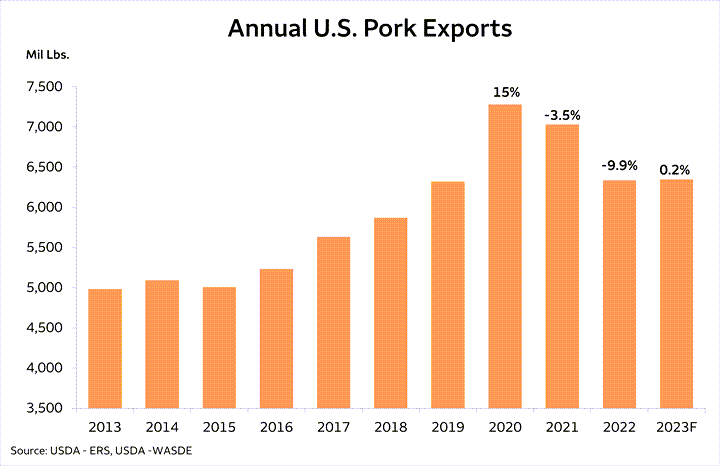

As the world’s largest producer of pork, the outbreak of African Swine Fever (ASF) devastated China’s hog industry in late 2018. With nearly 30% of their hog population decimated, China dramatically increased pork imports to shore up the loss of production and meet demand.

The U.S. was a benefactor with pork exports increasing 15% year over year in 2020. As China rebuilt their hog herd, they also moved their hog production sector toward more efficient large-scale commercial operations. The impact resulted in a quick retreat from pork imports, and subsequently, the U.S. experienced lower pork cutout prices in the second half of 2020 followed by a slowdown in pork exports in 2021 and 2022.

Newly identified ASF cases across China in 2023 have the hog industry speculating on the potential demand and pricing of U.S. hog exports, while also cautioning that the trend of higher pork exports could be short-lived.

What’s happening in China today?

Following China’s dismantling of their zero-COVID policy measures, many are wondering how their economy will rebound. There’s optimism economic growth will return in 2023, especially in China’s hospitality, restaurant, and institutional (HRI) sector as in-person dining and travel resumes. However, China has structural constraints that may limit growth. Consumer spending in China is uncertain, and the COVID virus remains a risk for spread through a population that has limited vaccine immunity.

Relations between the U.S. and China remain tense following the recent incident with the Chinese spy balloon discovered and shot down in U.S. territory, coupled with a meeting between China and Russia’s presidents, and Chinese threats against Taiwan. Changes in government policies from either country can quickly disrupt the flow of trade and have sudden impacts on agricultural commodities as evidenced by the agriculture industry impact following the trade dispute with China in 2018.

What does the future hold for China?

Accounting for a staggering 20% of the global population China is continually pressured to meet demand to feed its citizens. So, it’s no surprise that China is the largest consumer of agricultural goods. The country has instituted policies to control overpopulation, including the one-child policy, enacted in 1979, as they approached a population of one billion. This policy ran from 1980-2015 and is estimated to have curtailed at least 400 million births.

The lingering effect of this policy on China’s population is substantiated by the United Nations which predicts India will surpass China as the most populous country by summer of 2023. The latest U.N. World Population Prospects (WPP) report projects continued population declines in China with a worst-case estimated population at 494 million by 2100, translating to a 60% decline. Along with the population decline, China’s age demographics are shifting as a result of the one-child policy. Prior to the mandate, China’s median age was 21.5. This shifted to 38.4 in 2021, and by 2050 it’s estimated the median age may exceed 50.

How does this impact the U.S.? China is its biggest ag commodity buyer at present and if this projection holds true, U.S. agriculture will lose a hefty portion of its juggernaut customer base.

Summary

The U.S. food and agriculture industry must contend with the current trade dynamics with China. It’s an important partnership, but one with high volatility and increasing uncertainty. Longer-term, the U.S. needs to work toward expanding our trade footprint into other high growth emerging markets such as India and Northern Africa, with projected GDP growth of 55% and 39% respectively over the next five years. Increased diversity in U.S. trade partners will reduce our reliance on China and help moderate the short-term volatility, as well as the shifting demand of an aging and declining population.

Courtney Buerger Schmidt is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on the protein, cotton, and hay sectors. Courtney originally joined Wells Fargo in 2014 as a relationship manager within The Private Bank Wealth Management group where she spent two years prior to assuming her current role. Before Wells Fargo, Courtney spent six years as a commodity broker and research analyst with Frontier Risk Management developing hedge and risk management strategies for Agribusiness clients, and also served as assistant director of the research division that focused on livestock, grain, and oilseed.

Courtney Buerger Schmidt is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on the protein, cotton, and hay sectors. Courtney originally joined Wells Fargo in 2014 as a relationship manager within The Private Bank Wealth Management group where she spent two years prior to assuming her current role. Before Wells Fargo, Courtney spent six years as a commodity broker and research analyst with Frontier Risk Management developing hedge and risk management strategies for Agribusiness clients, and also served as assistant director of the research division that focused on livestock, grain, and oilseed.

Courtney holds a Bachelor of Science degree in Agricultural Economics with an emphasis in finance and real estate from Texas A&M University. Courtney was recently selected for Texas Agriculture Lifetime Leadership (TALL) Cohort XVIII 2022-2024. She is also a member of the Texas A&M College of Agriculture Development Council .

Lon Swanson is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on crop inputs, feed and forage (non-grain), peanuts, and seed.

Lon Swanson is a Sector Manager within Wells Fargo’s Agri-Food Institute focused on crop inputs, feed and forage (non-grain), peanuts, and seed.

Prior to joining Wells Fargo in 2002, he previously worked for Bank of America for 15 years in the Trust Department as a Farm Manager and Midwest Regional Supervisor. Lon was raised on a crop/livestock farm in Northeast Nebraska, and he began his professional career with Oppenheimer Industries as a Farm Manager.

Lon received a Bachelor of Science Degree in Agricultural Economics/Animal Science from the University of Nebraska and an MBA from Baker University. Professional credentials include a CTFA (Certified Trust and Financial Advisor) in 1992 and AFM (Accredited Farm Manager) in 1991. He has also maintained a Kansas Real Estate License since 1994.

Sign On

Sign On