Michael Swanson, Ph.D., Chief Agricultural Economist, Wells Fargo, Agri-Food Institute

There is an old saying in systems analysis about the problem of your thinking. It goes like this: "It isn't what you don't know, but it's what you know, that isn't so." I often joke that I'd rather be uninformed than misinformed because it's easier to correct.

There is an old saying in systems analysis about the problem of your thinking. It goes like this: "It isn't what you don't know, but it's what you know, that isn't so." I often joke that I'd rather be uninformed than misinformed because it's easier to correct.

When you are misinformed, you need to uproot a mistaken belief, which can be difficult. There is a seriously mistaken market belief that can cost you precious capital and create financial losses for your business. This belief is that there is a shortage of agricultural product in the world and it's getting worse. So, if you build and operate your business model around this belief, you will be fighting a losing financial battle.

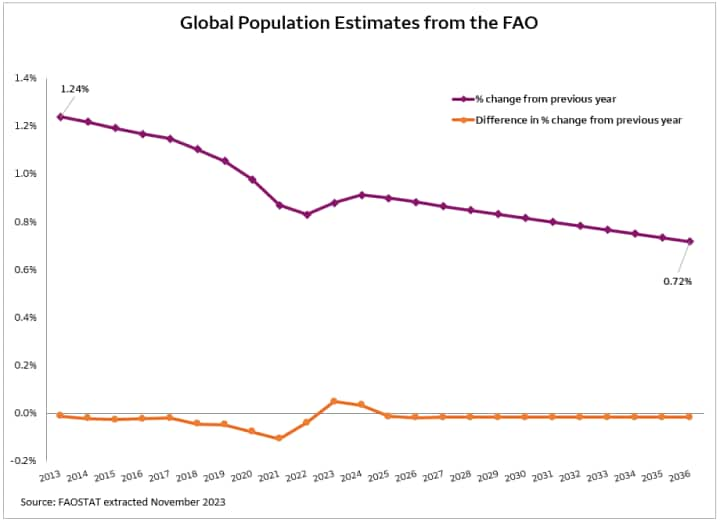

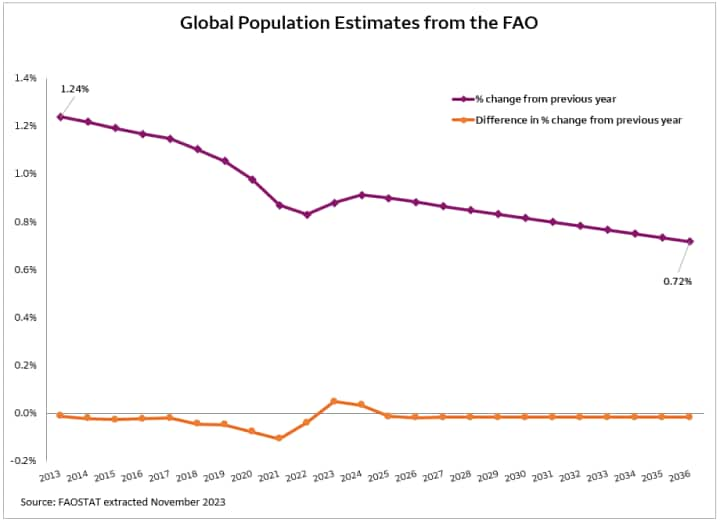

What we hear always is that climate change and a growing population are leading to food scarcity which implies higher food prices. Climate change is a hotly debated factor with an uncertain time horizon. Growing population is a much more certain factor, but it requires us to look at the three facets of a number. The first facet of the number is the number itself. The FAO, a part of the UN, estimates the global population as 8.045 billion people in 2023. The second facet of the number is its rate of change. The FAO estimates a 0.88% increase from the previous year. For context, the FAO estimated annual global population growth in 2013 to be 1.24%. The population growth rate has declined 29% in ten years. The third facet of the number is the change in the change of the number. For the last ten years, the change in the change has been negative. COVID related issues show 2023 and 2024 have positive values for the change in the change, but once again, starting in 2025, the change in the change goes negative again in their model. It's much smaller than the historical rate of slowing. It's their model, but population growth continues to slow noticeably.

FAO estimates, using the most recent production statistics through 2021, show that over the last decade, the primary crop production in metric tons grew to 4,722 billion metric tons in 2021 - the first facet of the number. The production grew by 2.2% from the previous year - the second facet of the number (change.) Change in the change was positive - 0.7% - the third facet of the number.

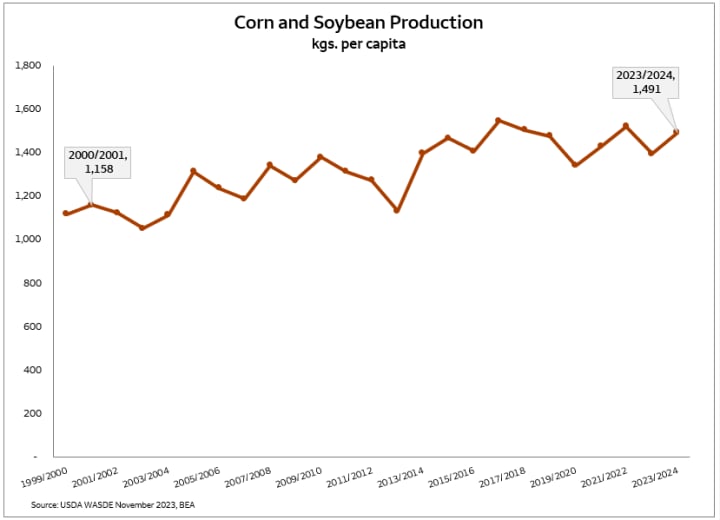

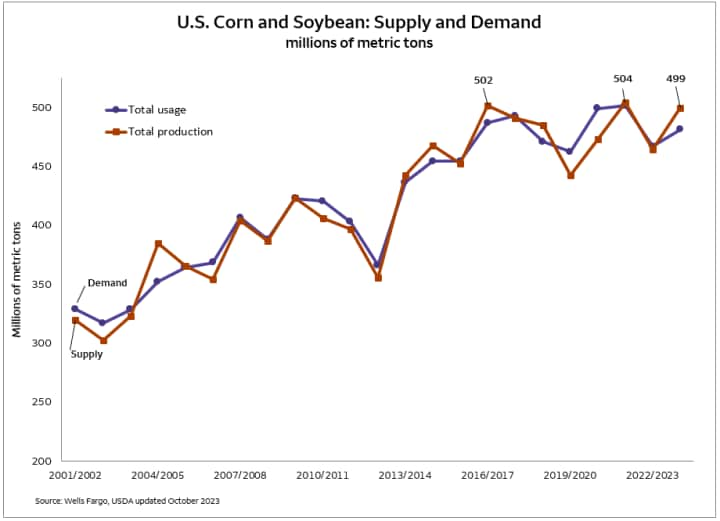

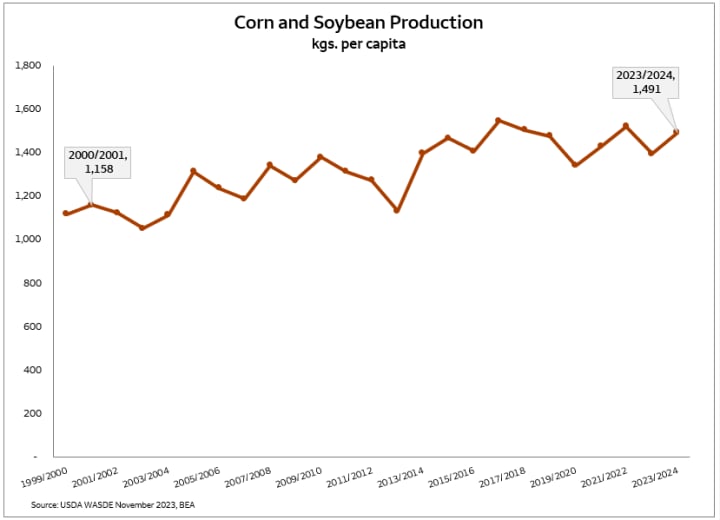

Crop production growth is certainly more volatile than population growth. However, it consistently outgrows population growth. Over the last 10 years, the FAO estimates that population grew by 10.4% and crop production grew by 20.3%, basically twice as fast. This dynamic of faster crop production growth compared to population growth will only accelerate. First, most of the world uses out-of-date production technology due to lack of access to capital and market distortions. Second, technology continues to accelerate the discovery of crop genetics and crop production yield enhancements. Lastly, population growth continues to slow.

The thermostat on the market's ability to produce more crops through increased capital and better technology is the "price" and "profitability" of those crops. The December 2023 corn future currently trades at $4.66 a bushel. When you do the math of calories per kilograms per dollar, you can buy approximately 20,000 calories for a dollar. According to the FDA and the USDA, the average daily requirement of calories is 2,000. So, you can buy 10 days' worth of calories for a dollar if you want to grind your own number 2 yellow field corn for arepas and tortillas. Of course, no one is interested in eating a corn-only diet, but it's ridiculously cheap when considered as a food source.

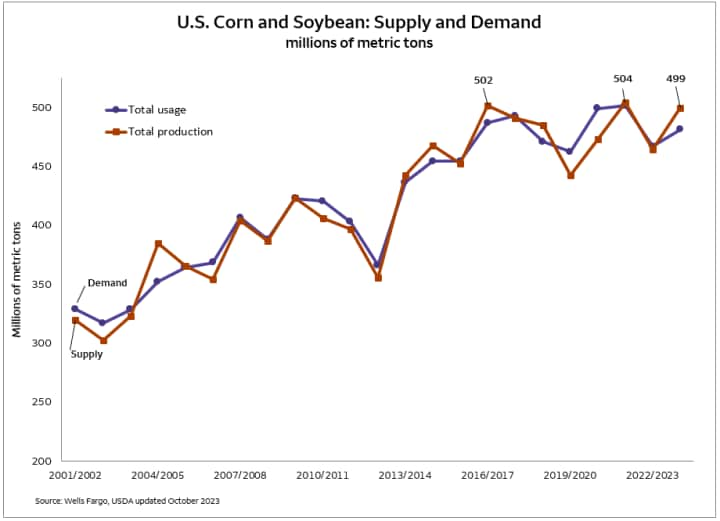

Additionally, we had a poor crop production this year and still ended up with cheap corn. The USDA's May 2023 estimate using trendline analysis forecasted 181.5 bushels per acre, and the November 2023 estimate came in at 174.9 bushels per acre - 3.6% below the trendline yield. If the yield would have come in at the average, the U.S. farmers would have produced 575 million more bushels. And, the extra crop would have depressed prices even further.

The U.S. uses a large percentage of its corn crop for biofuels because it can't sell it at a profit in the global markets as food or animal feed. Without biofuels usage, crop prices would plunge domestically and internationally as the knock-on effects take place. While consumers would enjoy cheaper food and feed prices temporarily, the lower prices would immediately knock out production both domestically and globally, thereby reducing supply. After a multi-year shakeout period, it is impossible to say at what price the market would settle. This depends on the global consumers' ability to pay for food which increases at a slower rate.

Ultimately, the price of global crop prices is a question of biofuels growth, not population growth. Biofuels growth hinges on its competitive ability to meet low carbon demand mandated by the government and other factors. Biofuels will battle solar, wind, and battery technology for a place in the energy markets. This is the competition that agricultural producers and input suppliers need to keep calibrated in investment outlooks. Circling back to the beginning, it isn't what we don't know. Instead, it's what we know that isn't so. When you are making multimillion dollar bets, take a moment to question what you think you know for certain.

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.

Michael joined Wells Fargo in 2000 as a senior economist. Prior, he worked for Land O’ Lakes and supervised a portion of the supply chain for dairy products, including scheduling the production, warehousing, and distribution of more than 400 million pounds of cheese annually, and also supervised sales forecasting. Before Land O’Lakes, Michael worked for Cargill’s Colombian subsidiary, Cargill Cafetera de Manizales S.A., with responsibility for grain imports and value-added sales to feed producers and flour millers. Michael started his career as a transportation analyst with Burlington Northern Railway.

Michael received undergraduate degrees in economics and business administration from the University of St. Thomas, and both his master’s and doctorate degrees in agricultural and applied economics from the University of Minnesota.

Sign On

Sign On  There is an old saying in systems analysis about the problem of your thinking. It goes like this: "It isn't what you don't know, but it's what you know, that isn't so." I often joke that I'd rather be uninformed than misinformed because it's easier to correct.

There is an old saying in systems analysis about the problem of your thinking. It goes like this: "It isn't what you don't know, but it's what you know, that isn't so." I often joke that I'd rather be uninformed than misinformed because it's easier to correct.

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.