Tim Luginsland, Sector Manager, Wells Fargo Agri-Food Institute with contributions from Jeff Millican, Central Region Leader, Wells Fargo Commercial Banking Agribusiness Group

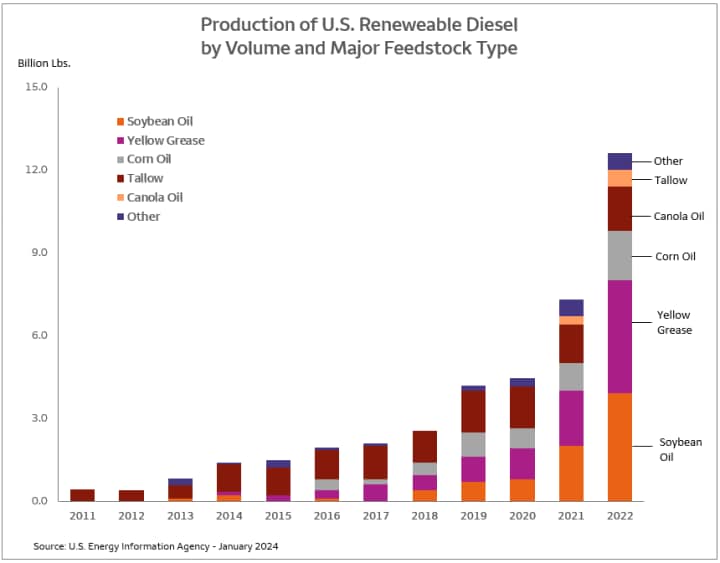

The U.S. is entering into a new era of renewable diesel fuel, potentially altering grain production numbers and flows. This is particularly true for soybeans — which when crushed into soybean oil — make up a major and growing component of renewable diesel.

The U.S. is entering into a new era of renewable diesel fuel, potentially altering grain production numbers and flows. This is particularly true for soybeans — which when crushed into soybean oil — make up a major and growing component of renewable diesel.

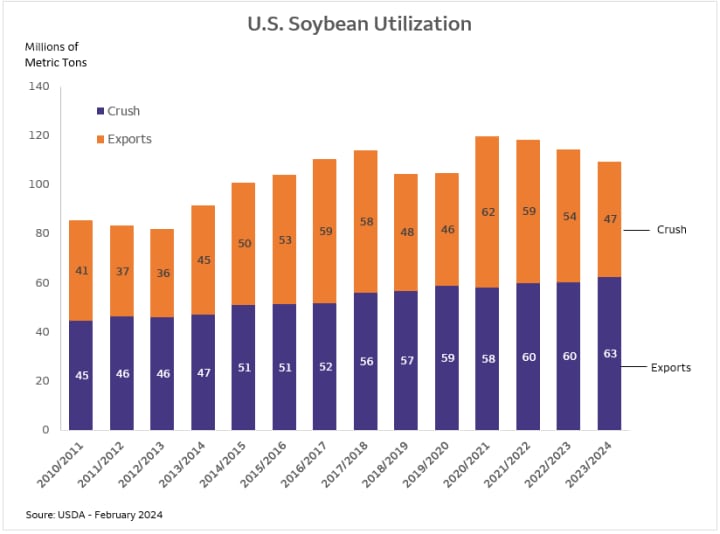

This growth in demand is welcome news for U.S. soybean growers and producers, who have seen steadily declining export markets for the past four years. The decline has occurred as the domestic crush has steadily increased, signaling to merchants that there is more value in generating extracted soybean oil domestically than exporting soybeans. Fortunately for the rest of the world, South America has been increasing soybean exports.

So, what’s driving the demand in renewable diesel and how is the U.S. soybean market responding?

State energy policies and federal tax credits spur demand

California, Oregon, and Washington already have energy policies in place encouraging the use of renewable diesel. And as of January 1, 2024, all California fleets used in construction, mining, industrial operations, and other industries are now required to procure and use only renewable diesel fuel in all vehicles subject to the Off Road Regulation. (Other states are likely to follow suit.)

Potential expansion of government incentives may play a large role in determining the rate of growth of renewable diesel fuel. It’s becoming a popular subject as renewable diesel is poised to play a key role in the effort to combat climate change.

For example, the U.S. Treasury Department increased the likelihood that corn-based ethanol and biomass-based diesel will soon be eligible for tax credits that are designed to encourage the production of sustainable aviation fuel (SAF). U.S. Department of Agriculture Secretary, Tom Vilsack, said the SAF market has the potential to reach 36 billion gallons per year, offering corn and soybean producers valuable access to a potentially large market. More specifics for the new proposal are due out this month.

Highest growth area for renewable diesel capacity

Between January 2022 and January 2023, the U.S. production capacity for renewable diesel and other biofuels increased by 1.25 billion gallons per year, representing a 71% increase. In January 2023, 11 states reported sites with renewable diesel and other biofuels production capacity, up from just six states in 2022.

Texas is an example of a state with new and growing capacity. Having no renewable diesel and other biofuels capacity in January 2022, by January 2023 Texas had 537 million gallons per year of capacity, the second highest following Louisiana. The production of biomass-based diesel - including biodiesel, renewable diesel, sustainable aviation fuel, and heating oil - reached 4 billion gallons in 2023, marking a one-billion-gallon increase from the previous year.

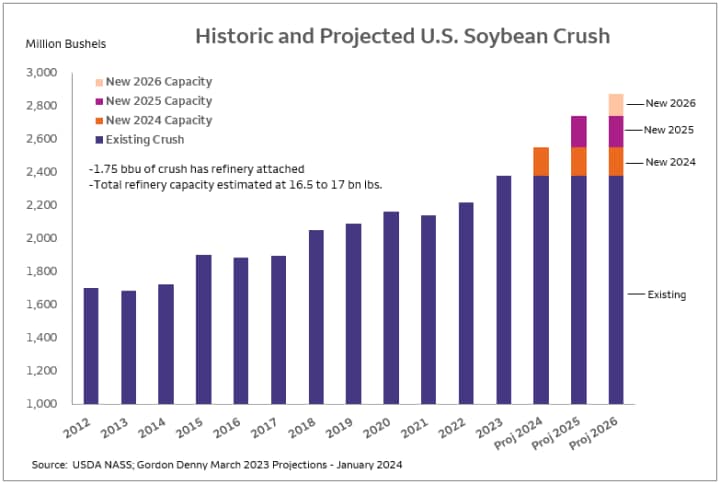

As renewable diesel capacity expands, so does the soybean crush

The crushing of soybeans has been prevalent over the last generation. Historically, two-thirds of crushed soybeans have been used to create soymeal for feed, with the balance turned into soybean oil for food. So, exactly what happens when the concept of producing diesel fuel able to support aviation, commercial trucks, trains, barges, and vessels from 100% soybean oil is introduced?

Opportunities abound

“Wells Fargo has seen an uptick in financing requests for new plant capacity over the last 18 months,” according to Jeff Millican, Central Region Leader within the Wells Fargo Commercial Banking Agribusiness group. “Many of the announced plants include large grain merchandisers and major oil companies as key investors, not typically as common in prior expansions of biofuel capacity.”

Of the 23 crush plant announcements, 13 are for new plants and 10 are expansion of current plants, with at least two already completed. However, announcements are not shovels in the ground. State and federal policy, permits, financing and many other issues will determine what happens next. Some facilities are already undergoing construction or have been completed, meaning the industry is already growing, but total expansion remains unknown.

This upward trend in soybean crush reflects the industry’s progress in broadening domestic crush capacity. For the 2021-22 marketing year, the American Soybean Association indicated the United States had around 60 crushing plants able to process approximately 2.2 billion bushels of soybeans annually. In 2023, domestic crushing capacity was expected to increase by 300,000 bushels per day based on expansions at three plants along with a new facility opening in North Dakota. In the December 2023 World Agricultural Supply and Demand Estimates (WASDE) report, the USDA forecasted 2023-24 U.S. soybean crushing at 2.3 billion bushels. With the 12 new plant openings and five planned expansions by 2026, soybean crushing capacity will expand even further potentially increasing the crush capacity by another 1.46 billion bushels per year.

“The global supply and demand trends will get accelerated as these new plants come online,” Millican said. “Regional imbalances will result in more material changes with local basis levels that impact planting decisions at the producer level.”

Of course, the energy, export and grain markets will determine to what extent crush plants will be built and soybean production will increase. Regardless, the demand for soybeans, and other oil sources, is bound to increase.

Stable industry sector experiences a jolt

So, while the grain industry has traditionally been a stable sector with occasional weather-related shocks, the rise of renewable diesel has become a game changer for the U.S. soybean market and the soybean crush. Though political incentives could change the timing, the current trajectory is for demand of soybean oil to grow significantly and for the U.S. soybean markets to find more economic value in domestic fuel production rather than in the export market.

Tim Luginsland is a Sector Manager within Wells Fargo’s Food and Agribusiness Industry Advisor group focused on the Dairy, Grain, and Oil Seed sectors. He has served in this role since 2000 and interfaces with dairy processors, grain merchants, milling companies, renewable fuel manufacturers, and exporters. Prior to joining Wells Fargo, Tim held various professional positions within the agricultural industry within the areas of farm management, milling and finance.

Tim Luginsland is a Sector Manager within Wells Fargo’s Food and Agribusiness Industry Advisor group focused on the Dairy, Grain, and Oil Seed sectors. He has served in this role since 2000 and interfaces with dairy processors, grain merchants, milling companies, renewable fuel manufacturers, and exporters. Prior to joining Wells Fargo, Tim held various professional positions within the agricultural industry within the areas of farm management, milling and finance.

Tim was raised on a diversified farm in Central Kansas. He has a Bachelor of Science degree from Kansas State University, and a Master of Science degree from the University of Arizona; both in agricultural economics.

Sign On

Sign On