March 11, 2025

Robin Wenzel, Group Head, Wells Fargo Agri-Food Institute

Later this year the U.S. Department of Agriculture (USDA) and the U.S. Department of Health and Human Services (HHS) will release the 10th edition of their Dietary Guidelines for Americans (Dietary Guidelines). These guidelines provide a blueprint for what to eat and drink for better health and disease prevention, and the scientific findings underpinning this report are stark when it comes to the state of the American diet and its impact on our health. Beyond this report we’re also seeing a continued rise in weight loss medication usage, the return of the wellness shopper, and potential new food regulations. Mix all this together and you’ll see an American food landscape ripe for change and innovation. Let’s dig in to see where the opportunities lie.

Capitalizing on fresh guidance

More than half of all adults in the U.S. have one or more preventable chronic diseases due to poor diets and not enough physical activity, according to the Dietary Guidelines for Americans. So, every five years, the USDA and HHS produce updated guidelines backed by new scientific research outlining recommendations for what we should eat and drink to live healthier lives and prevent disease. The scientific report that will inform the 2025-2030 guidelines was released in late 2024 and bluntly states how poor nutrition is creating a major public health challenge in the U.S. given the prevalence of obesity, and prediabetes among both adults and children.

The study looks at current dietary intakes throughout a person’s lifespan and how what we eat impacts our growth, development, health, and risk of disease throughout adulthood. The report also examines the ramifications of both underconsumption of certain dietary intakes such as vegetables and fruits, along with the risks of overconsumption of foods high in sodium, added sugars, and saturated fats.

Key insight: Food manufacturers can leverage these findings to develop products that align with the updated guidelines, such as reduced sodium options, lower-sugar snacks, and beverages, and added protein and plant-based protein options.

Catering to the food fluent, ready to spend, wellness shopper

We’ve all heard the adage “you are what you eat,” and in recent decades consumers have demonstrated growing interest in incorporating healthier versions of their favorite foods into their diet.

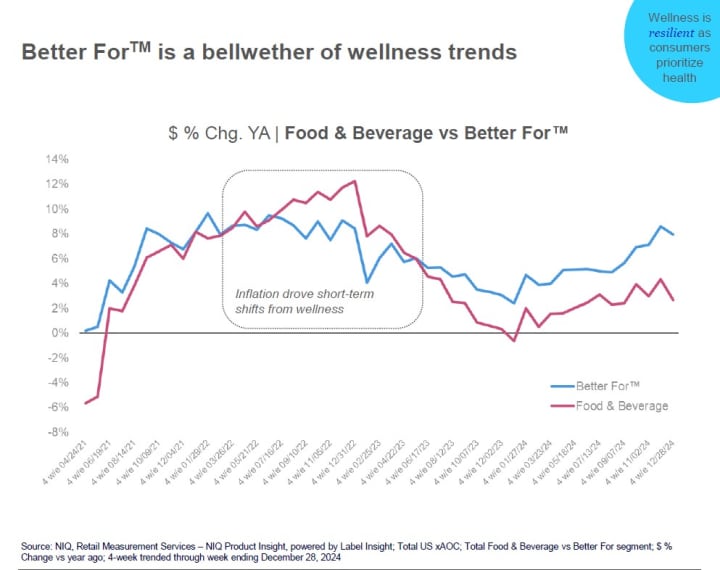

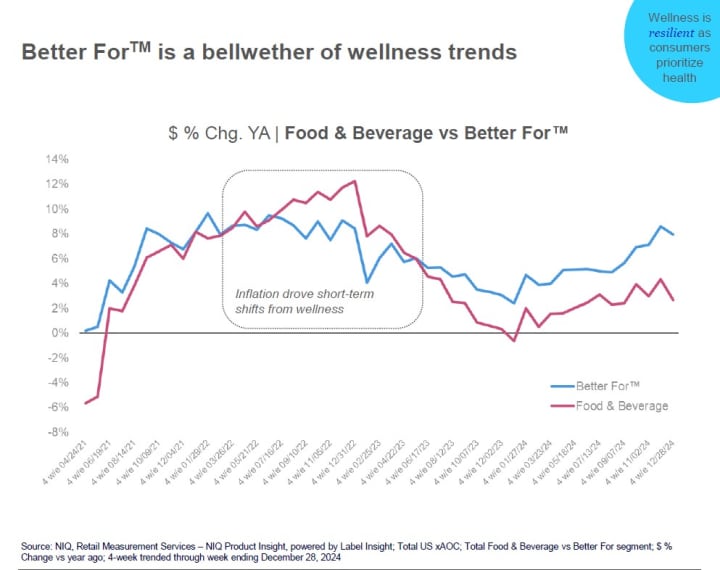

In fact, NielsenIQ has coined a Better For SegmentTM category in recognition that wellness is a growing core value for many shoppers, with 82% of U.S. consumers citing wellness as a top or important priority in their everyday lives. Even more, NielsenIQ has reported that some of these shoppers are also willing to spend a greater share of wallet on these products.

NielsonIQ defines their Better For SegmentTM as products that emphasize clean ingredients, sustainability, and ethical sourcing. They track more than 1,000 attributes across total store and more than 250 propriety attributes, providing product insights to qualify brands based on the variety of claims and certifications they make. They share these insights to help companies understand the current landscape and respond to evolving trends.

Through their research they have found that while at the height of our recent food inflation cycle, consumers spent less on Better For SegmentTM products, that trend line has shifted with the year-over-year increase in consumer spend on healthier, “Better For” products when compared to total Food & Beverage spend.

Key Insight: Whether baked versus fried or low sodium, sugar-free, or enriched with protein and fiber, interest in healthy versions of consumers’ favorite foods is growing. Taking an expanded view of this wellness category that goes beyond traditional definitions, like NielsenIQ has done with its Better For SegmentTM, is important for fully understanding the opportunity at hand.

Ditch the dyes and go on a European vacation

While most consumers acknowledge improvements in diet and lifestyle are likely to decrease the risk for chronic diseases, such as obesity and diabetes, a new conversation around food dyes and additives has sparked upcoming legislative changes that impact how food manufacturers will meet the new standards.

Many popular snacks and cereals manufactured and sold in the U.S. contain dyes and additives already restricted or banned elsewhere, including the European Union (EU) and Canada. These include :

| Dye / Additive restricted or banned in EU and other countries | Linked to | Found in some |

| Red Dye No. 3 | Cancer in animal studies | Snacks, candies, and various processed foods |

| Yellow Dye No. 5 | Allergens and hyperactivity in children | Sodas, snacks, cereals |

| Red Dye 40 | Allergens and hyperactivity | Beverages and processed snack foods |

| Brominated Vegetable Oil ("BVO") | Thyroid hormone disruption and neurological issues | Citrus flavored sodas |

| Potassium Bromate | Possible human carcinogen | Flour, used as an additive to improve dough elasticity |

| Titanium Dioxide | Possible carcinogen | Processed foods |

| Azordicarbonamide ("ADA") | Respiratory issues, skin irritation | Fast food bread products |

| Butylated Hydroxyanisole ("BHA") and Butylated Hydroxytoluene ("BHT") | Possible carcinogen | Chips, cereal, and processed meats |

| Recombiant Bovine Growth Hormone ("rBGH" and "rBST") | Increased cancer risk and antibiotic resistance | U.S. dairy cows to increase milk production |

While food manufacturers with global sales have reformulated their products to comply with the various guidelines from the EU and other countries, many of these manufacturers may now need to make similar modifications to their products sold in the U.S.

In 2023, California was the first in the U.S. to pass legislation to ban three additives and Red Dye No. 3 from food and beverages, effective in 2027. On Jan. 15 of this year, the U.S. Food & Drug Administration (FDA) announced it was revoking the authorization for the use of Red Dye No. 3, giving manufacturers until 2027 or 2028, respectively, to reformulate their products.

The additives - potassium bromate, brominated vegetable oil (“BVO”) and propylparaben – are already banned in numerous countries due to potential health risks. Should these be banned in the U.S., food manufacturers will be required to find alternate ingredients to replace these chemicals.

Some large food and beverage manufacturers have already taken proactive steps to remove these additives from their U.S. products. For example, Coca-Cola and PepsiCo have removed BVO from their beverage products and General Mills and Kellogg have reformulated certain cereals to replace the use of artificial colors and flavors with natural ingredients.

Everyday foods are being re-imagined, maximizing health benefits. Utilizing natural options like beet juice, spirulina and turmeric in place of artificial dyes; replacing artificial sweeteners and high fructose corn syrup with honey, maple syrup, monk fruit and stevia; and removing preservatives in favor of natural options are all areas that food and beverage manufacturers may opt to explore.

Food and beverage manufacturers with global sales will have the advantage as they have been early adopters to more restrictive compliance. In addition to sourcing new alternatives to reformulate the ingredients, manufacturers will need to ensure they work to closely retain flavor profile, shelf stability and other distinct attributes like crunch and color. Additionally, food manufacturers are actively seeking acquisition opportunities as a means of expanding healthy and clean label product offerings. An example of this includes Kraft Heinz's acquisition of Primal Kitchen, a natural food condiment and sauce manufacturer.

Key insight: While reformulating products takes time and money, companies who lean into these changes are poised to capture the growing consumer appetite for reduced additives. Even more, learning from companies who executed this process globally will be a tailwind for U.S.-based manufacturers.

Riding the GLP-1 Wave

As we explored in our Q4 2024 feature article, as GLP-1 medications have gained popularity for their effectiveness in weight loss, we’ve also seen growing demand for food products that complement these shifts in taste preference and lifestyle, leading to a rise in higher-protein and nutrient-dense options, among other shifts.

The recent launch of fruit spread Jam Pack’d, is an example of a nutrient-dense version of an everyday food item. Founders Michelle and Brian Platt sought to create a healthier fruit spread enriched with protein, prebiotic fiber, and touting a low glycemic impact with no added sugars. Their website encourages adding the superfood fruit spread to yogurt, oatmeal, pancakes, and no surprise, your PB&J sandwich, to increase your daily intake of key nutrients.

Key insight: Food and beverage product innovation stands to benefit as consumers seek out nutrient dense options with added fiber, protein, low-sugar and gut-friendly probiotics.

Gut check

The mass adoption of healthier foods is nowhere more apparent that with the expansion of grocery store chains like Trader Joe’s and Whole Foods that already ban certain additives from their shelves. While the scope, scale, and timing of any new regulation remains yet to be seen, progress has already been made by U.S. food and beverage manufacturers and retailers to support the growing focus on improving health and longevity within the American diet. Furthermore, the evolving landscape of nutritional science, consumer health trends, and potential regulatory changes can present fresh opportunities for those ready to respond to emerging trends.

Robin Wenzel is a senior vice president and the head of Wells Fargo’s Agri-Food Institute, a team of national industry advisors providing economic insights, analytics, research, and reporting across the agribusiness, food, and beverage spectrum. With more than 30 years of commercial and corporate banking experience, Robin leads with a strategic vision and an ability to expand and execute on the team’s deliverables to better support Food, Beverage, and Ag customers and prospects.

Robin Wenzel is a senior vice president and the head of Wells Fargo’s Agri-Food Institute, a team of national industry advisors providing economic insights, analytics, research, and reporting across the agribusiness, food, and beverage spectrum. With more than 30 years of commercial and corporate banking experience, Robin leads with a strategic vision and an ability to expand and execute on the team’s deliverables to better support Food, Beverage, and Ag customers and prospects.

Robin received her degree in Business from the University of San Francisco with an interest in Finance and International studies.

Robin has long been recognized for her work as a leading voice in the wine industry in Napa, CA. She is also a recipient of the 2017 North Bay Business Journal Women in Business Award.

Sign On

Sign On

Robin Wenzel is a senior vice president and the head of Wells Fargo’s Agri-Food Institute, a team of national industry advisors providing economic insights, analytics, research, and reporting across the agribusiness, food, and beverage spectrum. With more than 30 years of commercial and corporate banking experience, Robin leads with a strategic vision and an ability to expand and execute on the team’s deliverables to better support Food, Beverage, and Ag customers and prospects.

Robin Wenzel is a senior vice president and the head of Wells Fargo’s Agri-Food Institute, a team of national industry advisors providing economic insights, analytics, research, and reporting across the agribusiness, food, and beverage spectrum. With more than 30 years of commercial and corporate banking experience, Robin leads with a strategic vision and an ability to expand and execute on the team’s deliverables to better support Food, Beverage, and Ag customers and prospects.