The thermostat of investment

By Michael Swanson, Ph.D., Chief Agricultural Economist, Wells Fargo Agri-Food Institute

December 18, 2024

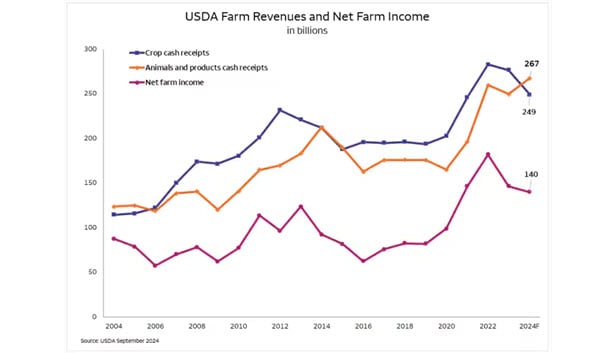

During the end of 2024, the story that the farm economy is in recession has been making the rounds throughout the media and the industry. First things first, industry sectors don’t go into recessions, rather they go through cycles. The term ‘recession’ only makes sense across the entire economy, and even there, we’ve only had four official recessions since 1982.

Slow growth is not a recession — no matter how much it stresses a particular industry sector — and reminds us to always take an economist’s recession forecast with this in mind. Four recessions in 43 years makes for a low probability event, not worthy of continual stress. The reason the U.S. economy seldom goes into recession is attributed to the facts that the U.S. is always adding to its labor force, accumulating capital, and incorporating new technologies. A true recession must overcome all three of these growth factors, difficult to do for a sustained time. And, this is true of the U.S. agricultural industry economy as well.

The U.S. farm economy, and its ability to make investments, continues to trend upward for the same three reasons. Growing population and growing income, both domestically and internationally, allow higher prices and greater volumes over time for agriculture and food sales. Technology, both industry specific and general economic enhancement, allows for greater production. And lastly, farmers continue to invest in capital stock because it has a positive return.

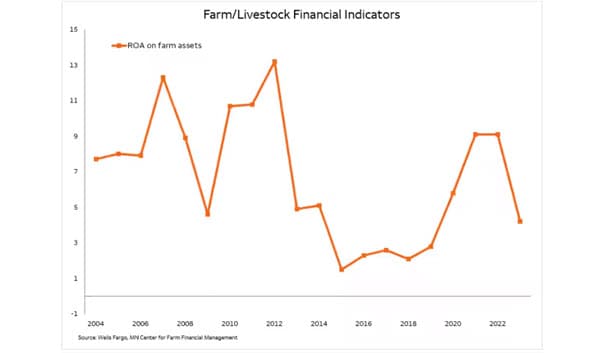

Using the last twenty years of data from the University of Minnesota’s Center for Farm Financial Management, agricultural producers in the upper Midwest averaged a 6.7% return on assets. This average certainly demonstrates the ‘flaw of averages’ since it has ranged as high as 13.2% in 2012, and as low as 2.1% in 2018. And within this average there is a lot of variation from high performers to low performers. It is the high performers who add the most capital since they are getting the best returns.

What are the raw materials for agricultural investment? What is the most favored asset? What is the thermostat for agricultural investment set at? Are we under or over performing against that benchmark?

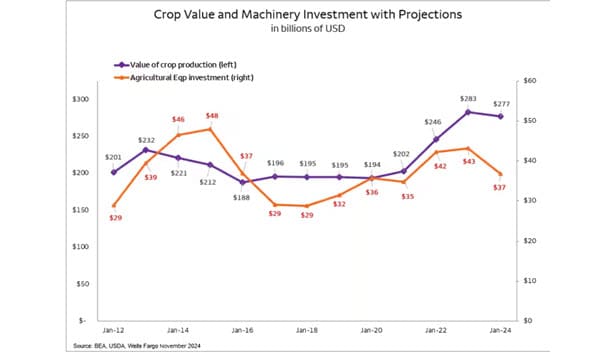

The raw materials for investment in agriculture are the gross revenues and net profits from the sector. All investment derives its value from the value of the output it helps to create. The chart below shows the value of crop production versus the investment in agricultural equipment. But, why not use total agricultural revenue including livestock? I have done the analysis which shows a stronger correlation with the crop segment than with the total agricultural revenue. The biggest variable in the crop revenue component comes from crop price changes which dwarfs the contribution from volume change for the majority of years. Farmers continue to invest in new equipment based on volume and technological improvement, even when they don’t feel good about putting in new dollars because they know that they can’t afford to fall behind the technology curve before the next up cycle.

The other thing to understand is that farmers and ranchers feel best about investing in farm and ranch ground. The 2024 USDA forecast for the balance sheet of agricultural producers estimates that 83.5% of agricultural assets are tied up in the land values, representing a value of $3.5 trillion dollars. Machinery and vehicles come in a distant second at 8.4%, at $0.36 trillion. Total estimated borrowings are $0.54 trillion, with most of that being debt for land purchases. This implies a net worth for the farming and ranching sector of $3.7 trillion. This is a sizable amount of equity which is very unevenly divided between the participants.

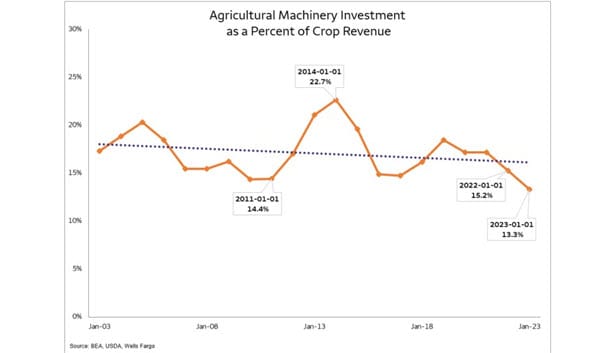

So, what’s a ‘reasonable’ expectation for agricultural equipment investment in 2024 and 2025? We have heard that farmers were less enthusiastic about making investments in 2024, but they certainly did not stop the process. Agricultural equipment producers face renewed competition after the COVID supply chain disruptions, and this helped to support firm pricing at the retail level. The recently released data from the Risk Management Association covering returns from April 2023 to March 2024 shows that both manufacturers and retailers of agricultural equipment saw margins and returns on assets settle downward, closer to the long run averages.

Looking at the thermostat of investment which drives reversion to the mean over time, it appears that farmers will have to increase agricultural equipment investment whether they feel good about it or not. The 2023 ratio of 13.3% was well below the long-term average of 17%, and the indications from sales data imply that 2024 will be below average. Looking back at the last cycle from 2012 to 2015 where we saw outsized investments, it only took a couple of years for the farmers and livestock operators to bounce back to a more normalized investment rate.

Referencing the Chicago Mercantile Exchange (CME) and the long-term futures prices for corn and soybeans, crop revenues should be relatively stable compared to the 2024 estimates. This top-line support and recent underinvestment on a percentage basis will give the farmers and livestock operators the support to continue making their capital investments. Unless the system gets changed, it is reasonable to expect it to continue to exhibit the same behavior as it has in the past.

Dr. Michael Swanson, Chief Agricultural Economist

Michael Swanson, Ph.D. is the Chief Agricultural Economist within Wells Fargo's Agri-Food Institute. He is responsible for analyzing the impact of energy on agriculture and strategic analysis for key agricultural commodities and livestock sectors. His focus includes the systems analysis of consumer food demand and its linkage to agribusiness. Additionally, he helps develop credit and risk strategies for Wells Fargo’s customers, and performs macroeconomic and international analysis on agricultural production and agribusiness.

Michael joined Wells Fargo in 2000 as a senior economist. Prior, he worked for Land O’ Lakes and supervised a portion of the supply chain for dairy products, including scheduling the production, warehousing, and distribution of more than 400 million pounds of cheese annually, and also supervised sales forecasting. Before Land O’Lakes, Michael worked for Cargill’s Colombian subsidiary, Cargill Cafetera de Manizales S.A., with responsibility for grain imports and value-added sales to feed producers and flour millers. Michael started his career as a transportation analyst with Burlington Northern Railway.

Michael received undergraduate degrees in economics and business administration from the University of St. Thomas, and both his master’s and doctorate degrees in agricultural and applied economics from the University of Minnesota.

RO-4970208

LRC-1125