Financial goals

There is no one way to set a goal

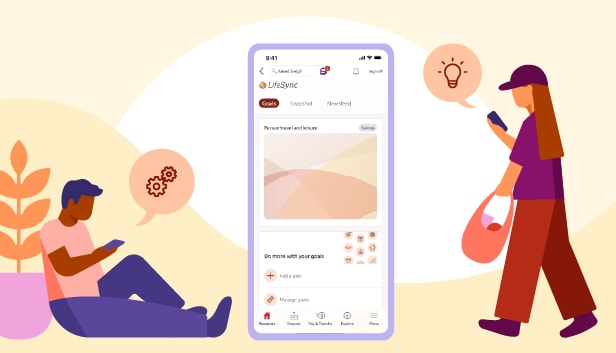

When it comes to setting goals, we understand your aspirations are as unique as you are.

Financial goals

Whether you're saving for your first home or aiming for a comfortable retirement, creating financial goals can be a great first step toward making your dreams a reality. We are here to help you take better control of your future, one money milestone at a time.

How was your experience? Give us feedback.

LifeSync® is available on the smartphone versions of the Wells Fargo Mobile® app. Additional device availability may vary. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

Wells Fargo Bank, N.A. Member FDIC.

PM-06232026-7469003.1.1

LRC-0125