A withdrawal strategy outlines how you plan to take money out of your retirement savings and fund your retirement years. It involves figuring out the timing, frequency, and amount of money you need to withdraw to ensure your savings last throughout your retirement while meeting your financial needs.

The best withdrawal strategy is one that fits your unique circumstances. Consider the size and contents of your investment portfolio, your income needs, your spending flexibility, and your risk tolerance.

Remember, the key to making your savings last is to accurately estimate and plan for the expenses you’ll face in retirement. Regularly review your retirement income plan, at least annually or whenever your circumstances change, to adjust your spending strategy and withdrawal rate as needed.

Choosing a sequence of retirement income withdrawals

The order in which you make withdrawals from different retirement accounts can have a big impact on how much you pay in taxes. For example, some people might first draw down their taxable accounts, which may be subject to capital gains taxes. This strategy allows money in tax-advantaged retirement accounts more time and therefore more growth potential. Then they might draw down tax-deferred accounts like a 401(k) account, which are subject to required minimum distributions (RMDs), followed by tax-free accounts, including Roth accounts. In other cases, individuals may want to draw down tax-deferred accounts first to limit the size of future RMDs.

Withdrawal sequencing can be a little bit complicated to figure out, and the best approach ultimately depends on your personal situation. A financial advisor can help you identify the most efficient order of withdrawals for your circumstances.

Understanding RMDs

As mentioned above, some accounts, including traditional individual retirement accounts (IRAs) and employee-sponsored qualified retirement plans (QRPs) such as a 401(k), 403(b), or governmental 457(b) plans, are subject to required minimum distributions (RMDs) required by the IRS once you hit a certain age. You must take RMDs by April 1 of the year after you turn 73 if you were born between 1951 and 1959 or by April 1 of the year after you turn 75 if you were born in 1960 or later.

The size of your RMD is found by dividing your account balance by a life expectancy factor determined by the IRS. Taking RMDs on time is very important since the IRS may levy an excise tax of 25% of the amount not taken by the RMD deadline. Note this excise tax can be reduced to 10% if corrected within two years.

Deciding how much to withdraw

You may come across several guidelines about how much you can safely withdraw once you retire. For instance, the 4% rule suggests that you withdraw no more than 4% of your retirement savings in the first year of retirement. Then you adjust the withdrawal amount for inflation in later years.

That said, how much you can withdraw once you retire will depend on your own savings and income needs as well as your RMDs. A financial advisor can work with you to find an amount that works for you.

Simplifying your finances with a single retirement income account

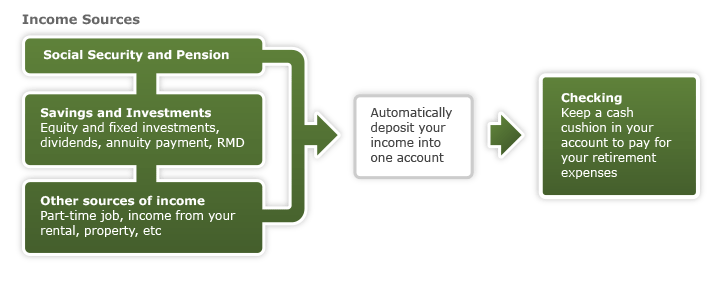

Before retirement, many people receive a single paycheck from their employer, which makes it relatively simple to manage their income. But managing your retirement income can feel a bit like juggling, with income coming from different sources at different times.

To make things easier, you can consider funneling income into one account, like your checking account.

Consider:

- Directly depositing Social Security, pensions, pay from a part-time job, and other retirement income into this primary account

- Setting up automatic transfers from your investment portfolio to this account

- Automatically sweeping any quarterly interest and dividend payments into your account

Keep a cash cushion in whatever account you primarily spend from, to help cover your expenses comfortably.

Your retirement income account

Traditional IRA distributions are taxed as ordinary income. Qualified Roth IRA distributions are federally tax-free provided it has been more than five years since the Roth IRA was funded AND the owner is at least age 59 ½ or disabled, or using the first-time homebuyer exception, or taken by their beneficiaries due to their death. Qualified Roth IRA distributions are not subject to state and local taxation in most states. Distributions from Traditional and Roth IRAs may be subject to an IRS 10% additional tax if distributions are taken prior to age 59 ½.

Withdrawals from QRPs are subject to ordinary income tax and may be subject to an IRS 10% additional tax for early or pre-59 ½ distributions.

Sign On

Sign On