Certificates of Deposit (CDs)

Lock in savings, keep your peace of mind

Minimum opening deposit: $2,500

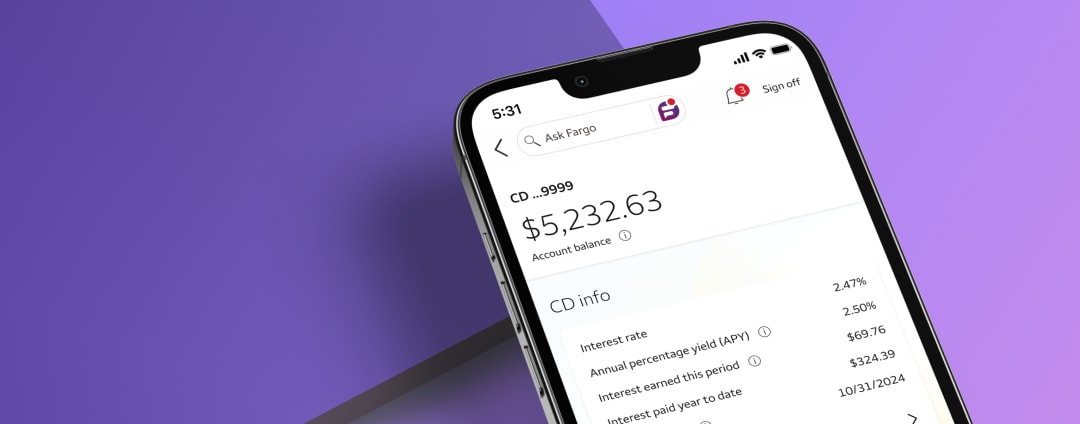

Screen image is simulated

Advantages of a Wells Fargo CD account

Better interest rates

CDs typically pay higher interest rates than other deposit products

Guaranteed return

Interest rate doesn’t change until your CD matures, so you know exactly how much you'll earn

Choose your own terms

Pick the length of time that works best for your savings needs or goals

FDIC-insured

Your funds are FDIC-insured up to the maximum applicable limits

Today's CD Special Rates

Today's Standard Fixed Rate CDs

3 month

Standard Fixed Rate

Rates are unavailable at this time. Please check back later or call us at 1-800-869-3557.

$2,500 minimum opening deposit

Early withdrawal penalties may apply

Additional terms are available at a branch

6 month

Standard Fixed Rate

Rates are unavailable at this time. Please check back later or call us at 1-800-869-3557.

$2,500 minimum opening deposit

Early withdrawal penalties may apply

Additional terms are available at a branch

1 year

Standard Fixed Rate

Rates are unavailable at this time. Please check back later or call us at 1-800-869-3557.

$2,500 minimum opening deposit

Early withdrawal penalties may apply

Additional terms are available at a branch

Certificate of Deposit FAQs

Renewal term

On the maturity date, your CD will automatically renew to the disclosed Renewal Term and effective Standard Interest Rate and Annual Percentage Yield (APY) unless you take action on the maturity date or within the following ten-calendar-day grace period.

Approximately 30 days before maturity, we will send you a notice reminding you of the maturity date and scheduled Renewal Term. Contact Wells Fargo on your maturity date or during your ten-calendar-day grace period to make any of the following changes: Renew your CD at a term and rates that is best for you, add funds or generally make withdrawals, close the CD.

Interest is only paid through the maturity date if you choose to withdraw funds or close your CD.

Special Interest Rate

Special Interest Rates are applicable to initial term only.

On the maturity date, Special Interest Rate CDs automatically renew to the disclosed Renewal Term and the interest rate will reset at the Standard Interest Rate and Annual Percentage Yield in effect on the maturity date unless the customer makes a change on the maturity date or within the ten-calendar-day grace period.

APY (Annual Percentage Yield)

The APY (Annual Percentage Yield) is a percentage rate that reflects the total amount of interest paid on the account, based on the interest rate compounded daily for a 365-day period.

If you receive a periodic statement, that statement will include the Annual Percentage Yield Earned (APYE) on your account for the period covered by the statement.

Current renewal APY

On the maturity date, your Special Fixed Rate CD will automatically renew to the disclosed Renewal Term and the Standard Interest Rate and Annual Percentage Yield (APY) in effect on that day unless you take action on the maturity date or within the ten-calendar-day grace period.

Relationship Interest Rate

A Relationship Interest Rate is an interest rate available on eligible Savings or CD accounts, when those accounts are linked to a Prime Checking or Premier Checking account.

How was your experience? Give us feedback.

Terms and conditions apply. Mobile carrier's message and data rates may apply. See Wells Fargo's Online Access Agreement for more information.

Terms and conditions apply. Setup is required for transfers to other U.S. financial institutions, and verification may take 1–3 business days. Customers should refer to their other U.S. financial institutions for information about any potential fees charged by those institutions. Mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for more information.

The monthly service fee for Wells Fargo Fixed Rate CDs is $0. The minimum opening deposit for a Standard Fixed Rate CD is $2,500, unless otherwise noted. Special Interest Rate CDs require a $5,000 minimum opening deposit unless otherwise noted. The minimum opening deposit is subject to change, as shown on wellsfargo.com/savings-cds/rates.

You may pay an early withdrawal penalty or a Regulation D penalty if you withdraw funds from your account before the term is complete. Some exceptions may apply. Penalties could reduce earnings on this account. The early withdrawal penalty amount is calculated and deducted from any earned interest. If the penalty is greater than the earned interest, the remaining penalty amount is deducted from the principal of the account.

The Regulation D penalty is seven days’ simple interest on the amount withdrawn and applies to:

- Withdrawals made within seven days of account opening including the day the account was opened.

- Withdrawals made during the grace period, when additional deposits are made during the grace period and the withdrawal exceeds the amount of the matured CD balance.

- Withdrawals within seven days of any prior withdrawal where the Bank’s early withdrawal penalty is not applied.

Other than the Regulation D penalty described above, any money withdrawn from the CD before the end of its term will be subject to an early withdrawal penalty based on the length of the CD term. If your term is:

- Less than 90 days (or less than 3 months), the penalty is 1 month's interest,

- 90 through 365 days (or 3-12 months), the penalty is 3 months' interest,

- Over 12 months through 24 months, the penalty is 6 months' interest, or

- Over 24 months, the penalty is 12 months' interest.

See the Consumer Account Fee and Information Schedule and Deposit Account Agreement for additional consumer account information.

The monthly service fee for Wells Fargo Fixed Rate CDs is $0. The minimum opening deposit for a Standard Fixed Rate CD is $2,500, unless otherwise noted. The minimum opening deposit is subject to change, as shown on wellsfargo.com/savings-cds/rates.

You may pay an early withdrawal penalty or a Regulation D penalty if you withdraw funds from your account before the term is complete. Some exceptions may apply. Penalties could reduce earnings on this account. The early withdrawal penalty amount is calculated and deducted from any earned interest. If the penalty is greater than the earned interest, the remaining penalty amount is deducted from the principal of the account.

The Regulation D penalty is seven days’ simple interest on the amount withdrawn and applies to:

- Withdrawals made within seven days of account opening including the day the account was opened.

- Withdrawals made during the grace period, when additional deposits are made during the grace period and the withdrawal exceeds the amount of the matured CD balance.

- Withdrawals within seven days of any prior withdrawal where the Bank’s early withdrawal penalty is not applied.

Other than the Regulation D penalty described above, any money withdrawn from the CD before the end of its term will be subject to an early withdrawal penalty based on the length of the CD term. If your term is:

- Less than 90 days (or less than 3 months), the penalty is 1 month's interest,

- 90 to 365 days (or 3-12 months), the penalty is 3 months' interest,

- Over 12 months through 24 months, the penalty is 6 months' interest, or

- Over 24 months, the penalty is 12 months' interest.

See the Consumer Account Fee and Information Schedule and Deposit Account Agreement for additional consumer account information.

A Relationship Interest Rate is variable and subject to change at any time without notice, including setting the interest rate equal to the Standard Interest Rate or to zero (0.00%), which could change the Relationship Annual Percentage Yield (APY). For CDs, the change will occur upon renewal. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain linked to a Prime Checking, Premier Checking or Private Bank Interest Checking account. Upon linking, or switching a linked account to an eligible savings account, it may take up to two business days for the Relationship Interest Rate to be applied to your eligible savings account. CDs must be linked at account open and/or at every renewal. If the checking account is closed for any reason or the eligible savings account or CD is de-linked, the account will revert to the then-current applicable Standard Interest Rate on that date; for CDs, this change will occur upon renewal. Any Special Interest Rate would not expire until the expiration date of that Special Interest Rate.

The minimum opening deposit for a Standard Fixed Rate CD is $2,500, unless otherwise noted.

Special Interest Rate CDs require a $5,000 minimum opening deposit unless otherwise noted. Public funds are not eligible for these offers. Special Interest Rates are applicable to initial term only. At maturity, Special Interest Rate CDs will automatically renew for the Renewal Term stated above, at the interest rate and Annual Percentage Yield (APY) in effect on the maturity date for CDs not subject to a Special Interest Rate, unless the Bank has notified you otherwise. The Bank may limit the amount you may deposit in this product to an aggregate of $2.5 million.

Current Deposit Rates for -

Annual Percentage Yields (APYs) and Interest Rates shown are offered on accounts accepted by the Bank and effective for the dates shown above, unless otherwise noted. Interest Rates are subject to change without notice. [Rates may vary by location.]

CD rates are fixed for the term of the account. A penalty may be imposed for early withdrawal from a CD. For CDs, interest begins to accrue on the business day you deposit non-cash items, such as checks. Penalties – including early withdrawal penalties – could reduce earnings. The early withdrawal penalty amount is calculated and deducted from any earned interest. If the penalty is greater than the earned interest, the remaining penalty amount is deducted from the principal of the account.

Interest is compounded daily. Payment of interest on CDs is based on term:

- For terms less than 12 months (365 days), interest may be paid monthly, quarterly, semi-annually, or at maturity (the end of the term).

- For terms of 12 months or more, interest may be paid monthly, quarterly, semi-annually, or annually.

CD rates are subject to change at any time and are not guaranteed until the CD is opened.

Early withdrawal(s) may be subject to either the Regulation D Penalty or the early withdrawal penalty. Some exceptions may apply.

The Regulation D penalty is seven days’ simple interest on the amount withdrawn and applies to:

- Withdrawals made within seven days of account opening including the day the account was opened.

- Withdrawals made during the grace period, when additional deposits are made during the grace period and the withdrawal exceeds the amount of the matured CD balance.

- Withdrawals within seven days of any prior withdrawal where the Bank’s early withdrawal penalty is not applied.

Other than the Regulation D penalty described above, any money withdrawn from the CD before the end of its term will be subject to an early withdrawal penalty based on the length of the CD term. If your term is:

- Less than 90 days (or less than 3 months), the penalty is 1 month's interest,

- 90 through 365 days (or 3-12 months), the penalty is 3 months' interest,

- Over 12 months through 24 months, the penalty is 6 months' interest, or

- Over 24 months, the penalty is 12 months' interest.

See the Consumer Account Fee and Information Schedule and Deposit Account Agreement for additional consumer account information.

Wells Fargo Bank, N.A. Member FDIC.

DT1-07232026-12-8237244-1.1