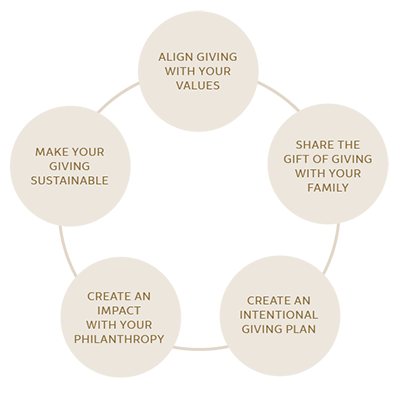

Our approach

Let’s work together to articulate your values and goals, define your measurement for success, and then determine next steps to help you maximize your impact.

Our services

- Investment selection and management aligning with your stated values, including environmental, social impact, and governance (ESG) options

- Specialized administration and support for a wide range of giving solutions, including donor advised funds, private foundations, charitable remainder trusts, and charitable lead trusts

- Investment strategies designed to help mitigate risk

- Grant and scholarship program management and support

- Dedicated web page for your foundation that supports online grant applications

Our solutions

Our specialists can help you determine which type of charitable giving structure works best for you, taking into account tax considerations and your need for income during your lifetime. Some common structures to consider are:

Donor Advised Fund

A donor advised fund (DAF) allows you to transfer assets irrevocably to a qualified public charity, typically receive an immediate tax deduction (in most cases, up to the full fair market value), and then recommend grant distributions to one or more charitable organizations on your timetable. The public charity manages the donations on behalf of an individual, family, or organization.

Private Foundation

Private foundations (nonprofit corporations or trusts with tax-exempt status) allow you and your family members—or others whom you designate—to maintain oversight of the amount, timing, and recipients of various grants. Many private foundations are formed to last in perpetuity, extending over multiple generations.

Charitable Remainder Trust

This type of trust combines the benefit of a current income stream with a future gift to charity. It provides income to one or more individuals during life or a term of up to 20 years with the remainder distributed to a qualifying charitable organization.

Charitable Lead Trust

This type of trust provides payments to one or more qualifying charitable organizations over a selected term of years or for the donor’s lifetime. At the time of its creation, the donor may be eligible for a significant gift tax deduction. After the stated term ends, the remaining assets are distributed to the donor’s named beneficiaries.