Clear Access Banking

Bank account with no overdraft fees. Period.

Open with $25

How to avoid the $5 monthly service fee

17 and under must open at a branch

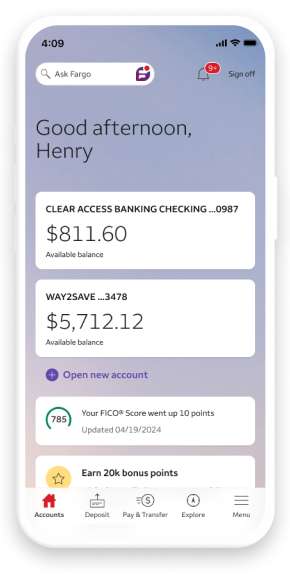

Screen image is simulated

Best account to help you manage your money

Great first bank account

Ideal as a first teen or student bank account, or second chance banking opportunity

Checkless banking

Mobile deposit, Bill Pay, and Zelle® make going checkless easy

Clear Access Banking fees and details

each fee period

You can avoid the monthly service fee with one of the following each fee period:

- Primary account owner is 13 - 24 years old

- A Wells Fargo Campus ATM Card or Campus Debit Card linked to this account

- A qualifying monthly non-civilian military direct deposit with the Wells Fargo Worldwide Military Banking program

- Must be 13 or older

- Teens 13 – 16 years old need an adult co-owner

- 17 and under must open at a branch

- IDs required to open

Bank with confidence

Bank Easy

Get the app loved by millions

9M ratings | 4.9 stars

Bank On certified

Clear Access Banking meets the Bank On National Account Standards for safe and affordable bank accounts with no overdraft fees.

Not sure which checking account is the best fit?

Compare all checking accounts

Take a quiz to find your account

Clear Access Banking FAQs

How was your experience? Give us feedback.

Other fees may apply, and it is possible for the account to have a negative balance. Please see the Wells Fargo Consumer Account Fee and Information Schedule and Deposit Account Agreement for details.

When the primary account owner reaches the age of 25, age can no longer be used to avoid the monthly service fee. Customers between 13 and 16 years old must have an adult co-owner.

You will receive your Worldwide Military Banking program benefits 45 days after your qualifying non-civilian military direct deposit is deposited into your eligible Wells Fargo checking account. For more information on the qualifying non-civilian military direct deposit, program qualifications and benefits, please visit wellsfargo.com/military/worldwide-military-banking or wellsfargo.com/depositdisclosures.

Mobile deposit is only available through the Wells Fargo Mobile® app on eligible mobile devices. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement and your applicable business account fee disclosures for other terms, conditions, and limitations.

Terms and conditions apply. Some (but not all) digital wallets require your device to be NFC (Near Field Communication) enabled and to have the separate wallet app available. Your mobile carrier’s message and data rates may apply.

Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers purchase protection for payments made with Zelle® - for example, if you do not receive the item you paid for or the item is not as described or as you expected. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution’s online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier's message and data rates may apply. Account fees (e.g., monthly service, overdraft) may apply to Wells Fargo account(s) with which you use Zelle®.

Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. Fargo is only available on the smartphone versions of the Wells Fargo Mobile® app.

You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO® Score available, and enrolled in Wells Fargo Online®. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details. Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier's message and data rates may apply.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Wells Fargo and Fair Isaac are not credit repair organizations as defined under federal and state law, including the Credit Repair Organizations Act. Wells Fargo and Fair Isaac do not provide credit repair services or advice or assistance with rebuilding or improving your credit record, credit history, or credit rating.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Turning off your debit card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made. Turning your card off will not stop card transactions presented as recurring transactions or transactions using other cards linked to your deposit account. Posting refunds, reversals, and credit adjustments to your account will continue. Any digital card numbers linked to the card will also be turned off. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

For customers unable to open a standard account due to past credit or banking history for the first 365 days from the date your new Clear Access Banking account was opened, you won't be able to convert into any other Wells Fargo account. After 365 days, you can convert into any Wells Fargo consumer checking account offered at that time.

If you convert from a Wells Fargo account with check writing ability to a Clear Access Banking account, any outstanding check(s) presented on the new Clear Access Banking account on or after the date of conversion will be returned unpaid. The payee may charge additional fees when the check is returned. Make sure that any outstanding checks have been paid and/or you have made different arrangements with the payee(s) for the checks you have written before converting to the Clear Access Banking account.

With Zero Liability protection, you will be reimbursed for promptly reported unauthorized card transactions, subject to certain conditions. Please see the applicable Wells Fargo account agreement or debit and ATM card terms and conditions for information on liability for unauthorized transactions.

With Early Pay Day, the Bank may make incoming electronic direct deposits made through the Automated Clearing House (ACH) available for use up to two days before the scheduled payment date. Not all direct deposits are eligible for Early Pay Day. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit. Whether we make funds available early depends on when we receive the payor’s payment instructions, any limitations we set on the amount of early availability, and standard fraud prevention screening. Available for personal accounts only. See our Deposit Account Agreement for more details.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iCloud Keychain, iPad, iPad Pro, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Wallet is a trademark of Apple Inc. App Store is a service mark of Apple Inc.

Android, Chrome, Google Pay, Google Pixel, Google Play, Wear OS by Google, and the Google Logo are trademarks of Google LLC.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

See the Consumer Account Fee and Information Schedule and Deposit Account Agreement for additional consumer account information.

Wells Fargo Bank, N.A. Member FDIC.

QSR-10192025-6567223.1.1

LRC-0424