Borrowing money

Borrow with your best interest in mind

Though borrowing may feel daunting, it doesn't have to be. Sometimes it can be viewed as a strategic move toward achieving your financial goals.

Get startedBorrowing done confidently

From planning a big purchase to tidying up your debt, take the first steps to navigate options that may be better suited to you and your needs.

With the right approach, a loan can help you invest in what matters most. Let’s explore how mortgages can help open doors.

- Consider credit as a starting point. Whether you're new to the home buying process or have experience, consider the 5 C’s of credit to better understand your mortgage approval odds: credit history, capacity, collateral (when applying for secured loans), capital, and conditions.

- Assess your current financial picture. Having a broader lens on your income vs. expenses is helpful. Try tracking money coming in and going out so you can understand the amount you can spend and how much you may need to borrow.

- Do the quick math: Use a mortgage calculator to help determine your buying power. A great start to your homebuying journey, it’s simple and can be done within seconds. Fortunately, we can help.

Education costs, whether for yourself or your child, can add up. Higher education like colleges and universities, vocational training, and private K-12 schooling can be among your costliest expenses.

- Start by recognizing that education can be the gift that keeps on giving. Consider how it may positively impact you or your child's life in the future.

- Begin to plan. What is the potential impact of this new payment amount on your monthly expenses? How much will you have to pay in the near term compared to the years to come? Are there trade-offs that you need to make to better manage a repayment plan? If so, are the returns worth it to you? Be sure to consider every angle.

- Have an honest conversation about your borrowing expectations. This can help you better manage debt effectively and plan accordingly.

Managing debt comes with its challenges, but it doesn’t have to be overwhelming. Consider these tips to help take better control of your borrowing needs.

- Start by assessing your total debt, including your mortgage, credit card balances, and other repayment obligations. Consider tackling debts with the highest interest rates first to help reduce the overall amount of interest paid over time.

- Try to make payments on time or ahead of due dates. If you’ve missed a payment, pay as soon as possible. On average, payment history makes up 35% of your credit score.*

- No matter how long you’ve been on your current payment plan, see if you qualify for lower rates, especially if your credit score has improved or if interest rates have decreased since your original application.

Discover more about borrowing

Explore borrowing options that may help assist you in meeting your financial goals.

Use our Debt-to-Income (DTI) calculator to help understand how your debt compares to your needs.

How was your experience? Give us feedback.

This calculator is for educational purposes only and is not a denial or approval of credit.

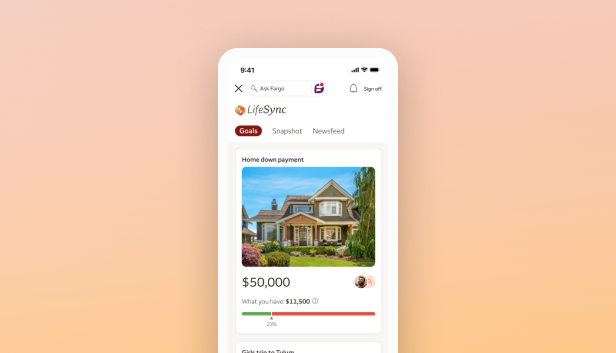

LifeSync® is available on the smartphone versions of the Wells Fargo Mobile® app. Additional device availability may vary. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

Wells Fargo Bank, N.A. Member FDIC.

QSR-06302026-7481660.1.1

LRC-0125