Investing money

Investing done confidently

Developing a strong investment strategy can help pave the way toward a brighter financial future. Explore your options and learn how you can start today.

Get startedNo more guessing, it’s time for guidance

Whether you’re just starting or taking the next step, we’re here to help with your investment journey — from setting your investment goals to balancing risks and rewards.

Hard work today can yield future rewards. Plan, save, and strategize to achieve your retirement goals.

- Review the options of your employee-sponsored qualified retirement plan (QRP), such as a 401(k), 403(b), or 457(b). Many companies that offer employer-matching and contributions to retirement accounts also have the benefit of tax-deferred growth potential — allowing your savings the opportunity to grow tax-deferred until time of distribution.

- Consider self-directed options like an individual retirement account (IRA) or a Roth IRA. Traditional IRAs offer tax-deferred growth opportunities while Roth IRAs offer tax-free potential. Explore the benefits of both.

- Compare the pros and cons of timing your retirement. If you think early retirement is for you, it may require more discipline upfront. Think about financial factors that may impact this decision, like if you own a home, have a business, or intend to start a family.

Building wealth takes time, and you deserve a plan that protects your progress. Consider the following tips to help you better protect yourself and your wealth.

- Try creating a strong financial foundation to help foster your monetary growth. This may include saving a percentage of your income, regularly contributing to your retirement account, or paying off high-interest debt.

- To safeguard what you’ve built, consider protecting your assets through insurance, establishing an emergency fund, or diversifying your investments. These strategies can help provide a buffer during financial challenges.

- Create long-term, practical habits that will help you achieve your financial goals to build and protect wealth. Establish routines and habits that work for you. Regularly check-in with yourself or a designated specialist to discuss how you’re doing. Ensure you’re saving for a rainy day and be intentional with your spending.

For those who are interested in values-aligned investing, start by defining your values through self-reflection or discussions with those closest to you.

- Identify your core values to create a clearer framework for your investment decisions. Are your values family and/or faith-based? How do you have these conversations with relatives? Begin by first understanding what's most important to you.

- Research companies committed to practices that mirror your values. Think about your interests and what you want your investments to go toward. You can make a list of companies you may be interested in, and discuss with those closest to you or investing alongside you.

- Regularly track and review your portfolio to make sure your investments still mirror your beliefs, values, and practices. Stay in the know on industry changes and adjust where you feel it's best.

Discover more about investing

Explore investment opportunities, learn why investing matters, how to start, and how to grow your wealth.

Withdrawals from employer-sponsored retirement plans may be subject to ordinary income tax and may be subject to an IRS 10% additional tax for early or pre-59 ½ distributions.

There is no assurance that investing based on Environmental, Social and Governance (ESG) considerations will be an effective investment strategy or that a strategy’s holdings will exhibit positive or favorable ESG characteristics. An investment strategy that takes in account ESG considerations is not solely focused on financial concerns and could cause it to forgo potentially profitable investment opportunities in certain industries, companies, sectors, or regions of the economy, potentially resulting in underperformance relative to similar portfolios that do not take ESG considerations into account. Risks associated with investing in ESG-related strategies can also include a lack of consistency in approach and a lack of transparency in manager methodologies. Investors should not place undue reliance on ESG principles when selecting an investment.

Guarantees are based on the claims-paying ability of the issuing insurance company.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

How was your experience? Give us feedback.

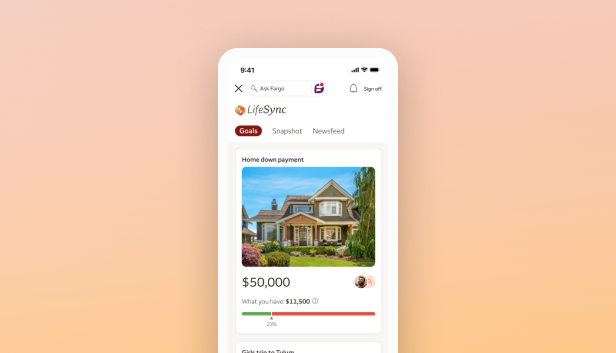

LifeSync® is available on the smartphone versions of the Wells Fargo Mobile® app. Additional device availability may vary. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

All investing involves some degree of risk, whether it is associated with market volatility, purchasing power, or a specific security. There is no assurance any investment strategy will be successful. Asset allocation does not guarantee a profit nor does diversification protect against loss.

Traditional IRA distributions are taxed as ordinary income. Qualified Roth IRA distributions are tax-free provided a Roth IRA has been open for more than five years and the owner is at least age 59 ½ or disabled, or using the first-time homebuyer exception, or taken by their beneficiaries due to their death. Qualified Roth IRA distributions are not subject to state and local taxation in most states. Distributions from Traditional and Roth IRAs may be subject to an IRS 10% additional tax if distributions are taken prior to age 59 ½.

Insurance products are offered through non-bank insurance agency affiliates of Wells Fargo & Company and are underwritten by unaffiliated insurance companies.

Wells Fargo Bank, N.A. Member FDIC.

PM-09042026-7616252.1.2

LRC-0325