Protecting money

The best protection is prevention

Financial reassurance goes beyond protecting your investments. Taking action to preserve your assets can help you achieve a well-rounded approach to your finances.

Get startedStart a new tomorrow, today

Helping to secure a better financial future for yourself and your family requires proactivity, but is worth it in the end. Open a dialogue, plan, and begin preparing for the future.

Differences in values and wealth levels can hinder financial conversations, especially among extended family. However, breaking through money taboos can help you reach your financial goals together.

- Bring your kids (or other younger generations) into the conversations. Are they aware of your goals? Have you discussed money regularly? By normalizing money conversations, you can help foster better family alignment.

- Involve family in planning. A collaborative approach promotes transparency and helps everyone understand the value of managing money wisely to prepare for the future. Create clear expectations and guidelines for joint decision-making.

- Regularly review and adjust your family's strategy to help protect loved ones now and in the long run. What does a good routine look like? Who's involved? Is it done in person or virtually? Is an external partner included?

Health is the ultimate wealth and investing in your own is important. Small, proactive steps today may positively impact your future and help improve your quality of life:

- Consider opening a dedicated healthcare savings account (HSA) or setting up automatic transfers to help grow your healthcare fund. Though you need a high deductible healthcare plan to open an HSA (oftentimes offered through your employer), you can keep your account no matter your employee status.

- Remember: your health is a valuable asset and should be treated as such. Look into long-term care insurance that will help cover healthcare expenses in your later years of life and/or can help offset certain costs.

- Research leveraging both insurance and HSAs and how doing so could minimize negative cost impacts and provide tax benefits. Prioritizing your healthcare not only helps support your physical self, but your financial goals too.

Estate planning and preservation isn't always the easiest conversation to have. But it's a necessary one. Developing an estate plan helps you prepare for - and start taking control of - your future.

- Consider the benefits of creating a comprehensive estate plan. Having legal documents can help ensure your wishes are honored and can provide clarity for loved ones during a difficult time.

- A last will and testament declares your distribution plans. You can also use various trust structures to control your distributions, provide asset protection, and/or achieve tax benefits.

- Examine and update your estate plan regularly to reflect any changing circumstances in your life. Be sure to communicate your plans openly with loved ones to minimize misunderstandings. Regular communication now is a key component in working through difficult conversations later.

Discover more about financial protection

Understand why financial protection is important and how you can better protect yourself.

How was your experience? Give us feedback.

Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

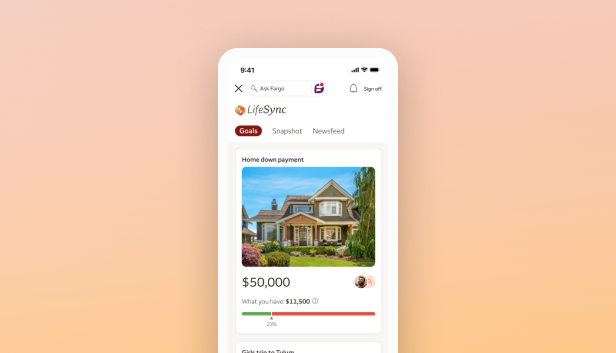

LifeSync® is available on the smartphone versions of the Wells Fargo Mobile® app. Additional device availability may vary. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Guarantees are based on the claims-paying ability of the issuing insurance company.

Insurance products are offered through non-bank insurance agency affiliates of Wells Fargo & Company and are underwritten by unaffiliated insurance companies.

Wells Fargo and Company and its Affiliates do not provide tax or legal advice. This communication cannot be relied upon to avoid tax penalties. Please consult your tax and legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your tax return is filed.

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

Wells Fargo Bank, N.A. Member FDIC.

PM-07062026-7499587.1.1

LRC-0125