Saving money

It starts with saving

Achieving your financial goals requires time and effort but with a little commitment, you can start today. Learn about the benefits that may come with establishing a savings strategy.

Learn moreEven a small step forward can be a step in the right direction

Taking the first step towards savings can be daunting. When should you start? How much do you need? Let us help you make sense of your savings goals and go from "one day" to "day one."

Finding ways to better manage spending can be tough, but you’re not alone. In fact, 80% of Americans want to learn more effective ways to manage their money.* Fortunately, with a little prioritizing, you can improve your approach to spending and saving.

- First, assess your spending habits. Understanding where your money is going each month will better help you measure and manage it.

- Ask the important questions. Is there a specific reason why you’re looking to better manage your spending? Write down your goals, and specify what you’re saving for, such as a new car or a DIY home renovation project.

- Set a timeline — whether it’s six months from today or three years from now. Visualizing and creating a clear target can be a motivating force to stay focused on your end goal.

When gearing up to make a big purchase, the right savings plan can help you get there sooner.

- Research and compare prices to find options that best align with your needs. Take time to explore various retailers and vendors (either online or in-person) to help ensure you’re getting the best possible rate and value for your dollars.

- Create a savings plan with your chosen item in mind. Insert a few money milestones that work with your timeline and can help you better stay on track toward your goal. Some milestones might include the amount you want to reach at the end of each week, month, or quarter.

- Consider opening a designated account with a nickname that reflects your savings goal, such as “Dream Vacation Fund,” “Big Day Fund,” or “My Nest Egg.” This can help motivate you as you’re saving for your big purchase.

Unexpected events can disrupt your financial stability. This can be anything from a home or car repair to a medical emergency. Preparing for situations like this can help better protect you.

- Build an emergency fund. Aim to save three to six months’ worth of living expenses in an account separate from your everyday checking or savings accounts.

- Start small by putting a portion of your income into your emergency account each month. What you contribute may change each month and that’s okay. To build this account, choose an amount and cadence that works best for you.

- Review how you approach these funds every 6 to 12 months. Three months of living expenses five years ago may look different than three months of living expenses today, and you want to be sure you have a solid financial cushion.

Discover more about saving

Learn why saving matters and how to better manage your money.

Open a savings account and set up automatic transfers to help you reach your money goals. Whether you're just starting out or need to revisit your spending and savings strategy, we can help.

Calculate your savings target in a few steps. Check out our Fargo® toolOpens a modal dialog for footnote 1 to better gauge your financial footing, track your spending, and see your account insights.

How was your experience? Give us feedback.

1.

Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

2.

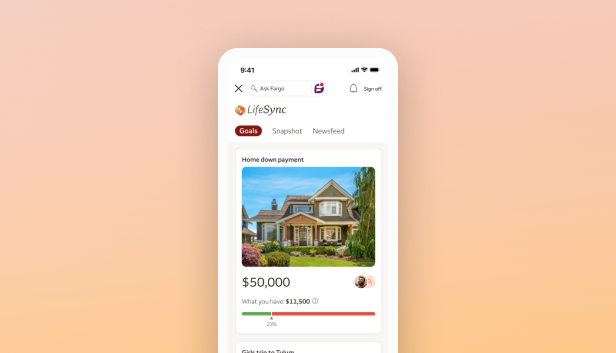

LifeSync® is available on the smartphone versions of the Wells Fargo Mobile® app. Additional device availability may vary. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply.

Screen images are simulated. Features, functionality, and specifications appearing in those images may change without notice.

Wells Fargo Bank, N.A. Member FDIC.

QSR-06302026-7481788.1.1

LRC-1224