Platinum Savings

Relationship rates available

Earn a Relationship Interest Rate when you link your Platinum Savings account to an eligible checking account

Flexible access to your money

Your money will be ready when you need it — through online or mobile access, unlimited branch and Wells Fargo ATM withdrawals, and the option to write checks

Platinum Savings

Standard Interest Rates

Rates are unavailable at this time. Please check back later or call us at 1-800-869-3557.

Avoid the $12 monthly service fee with a $3,500 minimum daily balance each fee period.

$25 minimum opening deposit

Account fees and details

- You must be 18 or older to apply online

- View age and ID requirements to open

- Minimum opening deposit: $25

Savings account features

Optional Overdraft Protection

Use your Platinum Savings account to help protect your linked Wells Fargo checking account from overdrafts.

My Savings Plan®

To help you set and track your goal, plus automatic transfers to make saving easy.

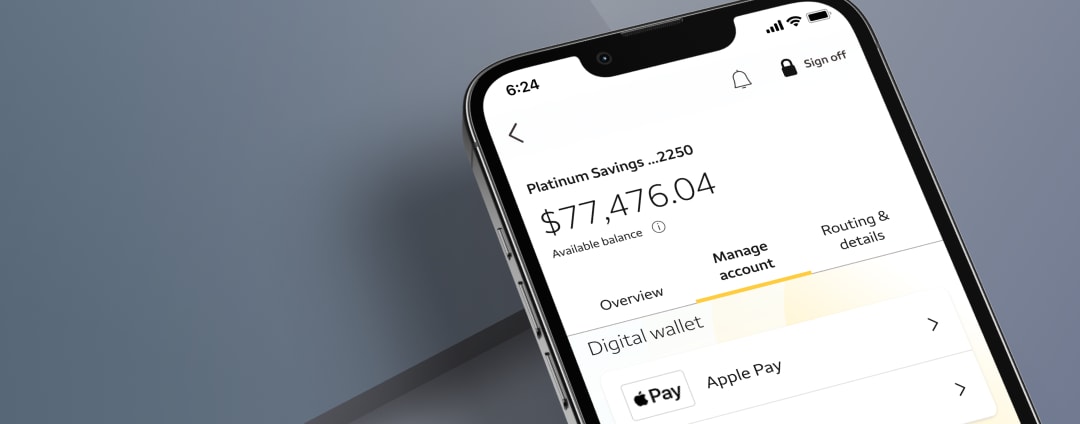

Manage your account

Additional resources

APY (Annual Percentage Yield)

The APY (Annual Percentage Yield) is a percentage rate that reflects the total amount of interest paid on the account, based on the interest rate compounded daily for a 365-day period.

If you receive a periodic statement, that statement will include the Annual Percentage Yield Earned (APYE) on your account for the period covered by the statement.

Relationship Interest Rate

A Relationship Interest Rate is an interest rate available on eligible Savings or CD accounts, when those accounts are linked to a Prime Checking or Premier Checking account.

How was your experience? Give us feedback.

The fee period is the period used to calculate the monthly service fee. The fee period details are provided on the Monthly Service Fee Summary located in your account statement.

Subject to account eligibility requirements.

My Savings Plan requires a Wells Fargo savings account.

Terms and conditions apply. Setup is required for transfers to other U.S. financial institutions, and verification may take 1–3 business days. Customers should refer to their other U.S. financial institutions for information about any potential fees charged by those institutions. Mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for more information.

Current Deposit Rates for -

A copy of the then-current rate sheet will be provided to you before you open your account or is available at any time upon request from a banker.

A Relationship Interest Rate is variable and subject to change at any time without notice, including setting the interest rate equal to the Standard Interest Rate or to zero (0.00%), which could change the Relationship Annual Percentage Yield (APY). For CDs, the change will occur upon renewal. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account or CD must remain linked to a Prime Checking, Premier Checking or Private Bank Interest Checking account. Upon linking, or switching a linked account to an eligible savings account, it may take up to two business days for the Relationship Interest Rate to be applied to your eligible savings account. CDs must be linked at account open and/or at every renewal. If the checking account is closed for any reason or the eligible savings account or CD is de-linked, the account will revert to the then-current applicable Standard Interest Rate on that date; for CDs, this change will occur upon renewal. Any Special Interest Rate would not expire until the expiration date of that Special Interest Rate.

See the Consumer Account Fee and Information Schedule and Deposit Account Agreement for additional consumer account information.

Wells Fargo Bank, N.A. Member FDIC.

QSR-07092026-7513930.1.1

LRC-1224